Thanks for Meeting Us at the IBAO!

As a new MGA built exclusively for Canadian insurance brokers, Private Collection Insurance is thrilled to participate in our first IBAO this year in Niagara Falls.

We look forward to working together to protect what your clients collect.

Please scroll down to learn more about Private Collection Insurance and how we can help you place the specialty and high-value risks your standard markets can’t!

Built for Brokers, Backed by Collectors

As an MGA, Private Collection Insurance (PCI) was created to solve a clear problem: high-net-worth clients and niche commercial risks are often underserved by standard carriers. Our team of underwriters and product specialists are lifelong collectors, retail advisors, and insurance professionals who understand the complexity of covering what matters most, because we lived it.

What to Expect From Private Collection Insurance

Our team works exclusively with licensed Canadian insurance brokers like you. We don’t go direct to your clients. Our role is to support your brokerage by providing expert underwriting, fast turnaround, and access to meaningful capacity for risks that require more than a generic policy.

Is Your Brokerage Meeting The Unique Demands of Your High Net-Worth Clients?

High-net-worth clients with high-value collections—fine art, luxury vehicles, rare memorabilia, collectibles and jewellery—expect tailored insurance solutions that match the sophistication of their assets. But for many brokerages, accessing these specialized programs can be a challenge, creating gaps in coverage and missed opportunities.

Why Partner with Private Collection Insurance?

Unlock exclusive opportunities with a partner that understands the intricacies of high-value collections. By partnering with Private Collection Insurance, your brokerage can unlock exclusive opportunities and deliver exceptional service to your most discerning high-net-worth clients.

Want to Learn More? Book a 10-minute call.

From luxury handbags and fine jewellery to gun shop inventory, sports cards, exotic cars and more, we offer brokers capacity where most carriers can’t.

Insurance for High-Value Items & Collectibles

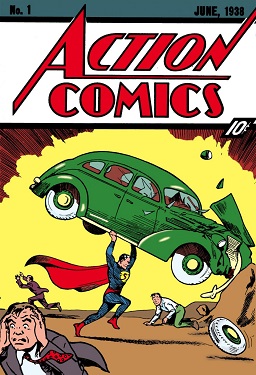

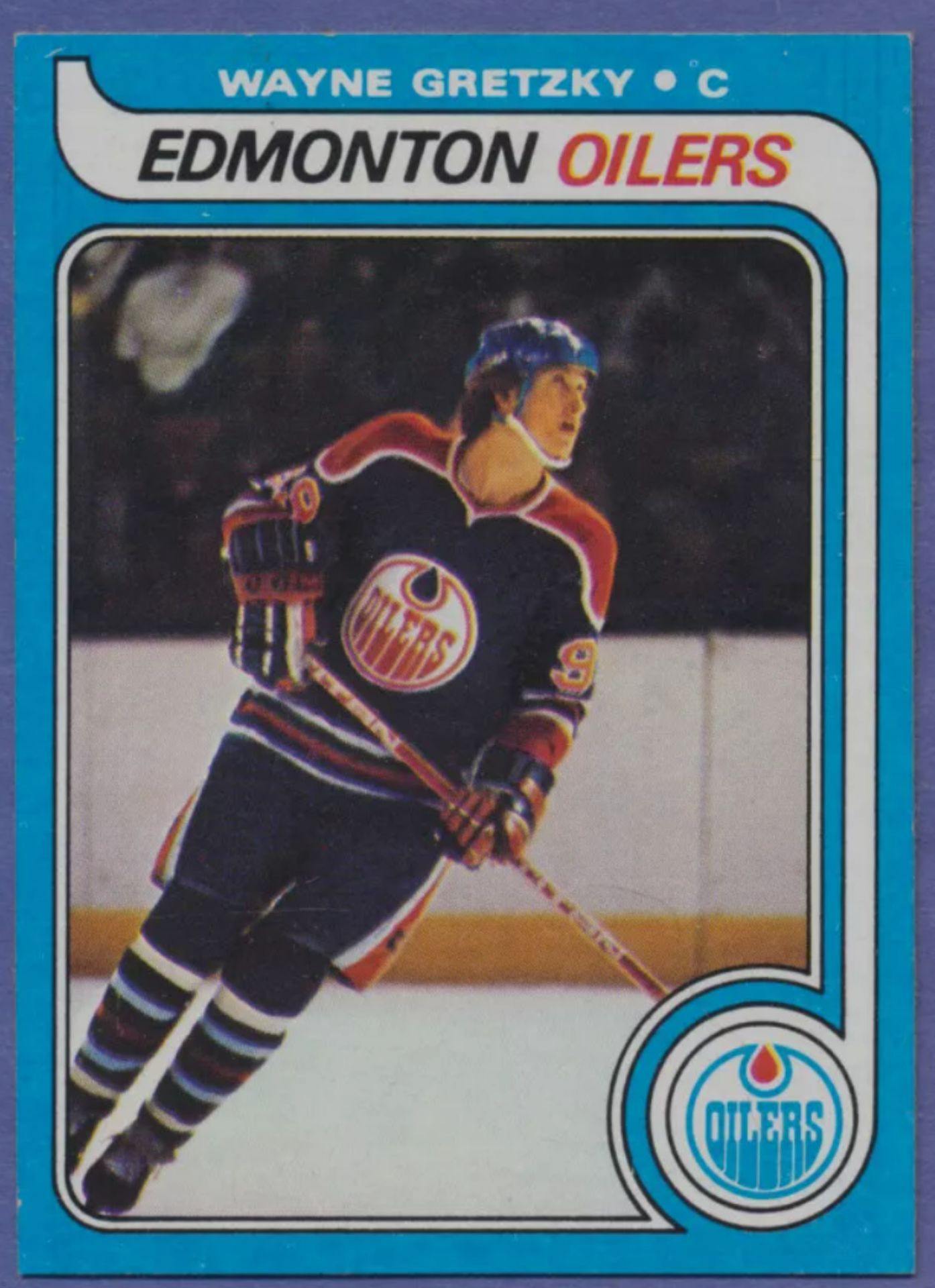

Private Collection Insurance (PCI) offers tailored insurance solutions designed to protect a wide range of rare and valuable items including, but not limited to Jewellery, Watches and Timepieces, Fine Art, Wine and Whiskey, Sports Cards, Comic Books, Memorabilia, Vinyl Records, Musical Instruments, Static Vehicle Collections, Coins, Firearms, Purses and Fashion, and other high-value items.

Jewellers Block Insurance

Protect your jewellery business with specialized Jewellers Block Insurance designed to address the unique risks faced by jewellery retailers, wholesalers, and manufacturers. From high-value inventory, goods on consignment, raw materials, liability concerns and transportation challenges, our comprehensive coverage ensures your business is secure against unforeseen losses.

Key Coverage Features:

- Inventory Protection: Safeguard your valuable stock, including finished jewellery, loose stones, watches, and precious metals, against theft, fire, damage, or loss.

- Transit Coverage: Comprehensive protection for goods in transit, whether shipped domestically, internationally, or hand-carried.

- On-Premises and Off-Premises Protection: Coverage for inventory stored in your showroom, safe, or off-site at exhibitions, trade shows, or during client appointments.

- Liability Protection: Coverage for third-party claims related to property damage or injury occurring on your premises.

- Business Interruption: Income protection for financial losses resulting from disruptions caused by a covered incident.

Firearms Business Insurance

Protect your gun shop with specialized insurance designed to address the unique risks and challenges firearm retailers face in Canada. From strict regulations and liability concerns to inventory management and unexpected losses, our tailored coverage ensures your business is safeguarded.

Key Coverage Features:

- Liability Protection: Comprehensive coverage for third-party bodily injury or property damage arising from operations, sales, or range activities.

- Inventory Coverage: Protect your valuable firearms, ammunition, and accessories against theft, fire, water damage, or accidental loss.

- Compliance with Canadian Legislation: Our policies adhere to federal and provincial regulations, ensuring your coverage aligns with stringent firearm industry requirements.

- Business Interruption: Coverage for income loss resulting from a covered incident, keeping your operations financially secure during downtime.

- Transit Protection: Safeguard firearms and accessories during deliveries, transfers, or shipments

Key Features of Collectibles Insurance

Private Collection Insurance (PCI) offers tailored insurance solutions designed to protect a wide range of rare and valuable items including, but not limited to Jewellery, Watches and Timepieces, Fine Art, Wine and Whiskey, Sports Cards, Comic Books, Memorabilia, Vinyl Records, Musical Instruments, Static Vehicle Collections, Coins, Purses and Fashion, and more.

Our expertise and exclusive Lloyd’s of London market access allow us to provide unparalleled coverage options, ensuring your clients’ collections are safeguarded against risks including:

- All-Risk Protection: Comprehensive coverage for theft, fire, accidental damage, natural disasters, and more.

- Worldwide Coverage: Protection anywhere in the world, whether at home, in storage, or in transit.

- Loss of Value Protection: Safeguard against depreciation from damage, maintaining market value.

- Blanket Coverage: Automatic protection for new acquisitions, simplifying policies for growing collections.

- Flexible Premium Options: Tailored premiums to fit collections of all sizes.

- Transit Coverage: Specialized protection for items in transit for grading, display, or trade.

Take The Next Step with Private Collection Insurance

Private Collection Insurance (PCI) helps brokerages like yours stand out in a competitive market by offering bespoke insurance solutions for high-value collections and luxury assets. PCI brings together a deep understanding of insurance and a lifelong passion for collecting.

The Official Event & Vendor Insurance Partner

Take The Next Step with Private Collection Insurance

We partner with brokerages across Canada to deliver bespoke insurance solutions that enhance client relationships, unlock new revenue streams, and position your brokerage as a leader in the high-value market.

Want to Learn More? Book a 10-minute call.

From luxury handbags and fine jewellery to gun shop inventory, sports cards, exotic cars and more, we offer brokers capacity where most carriers can’t.