Vinyl Record Insurance

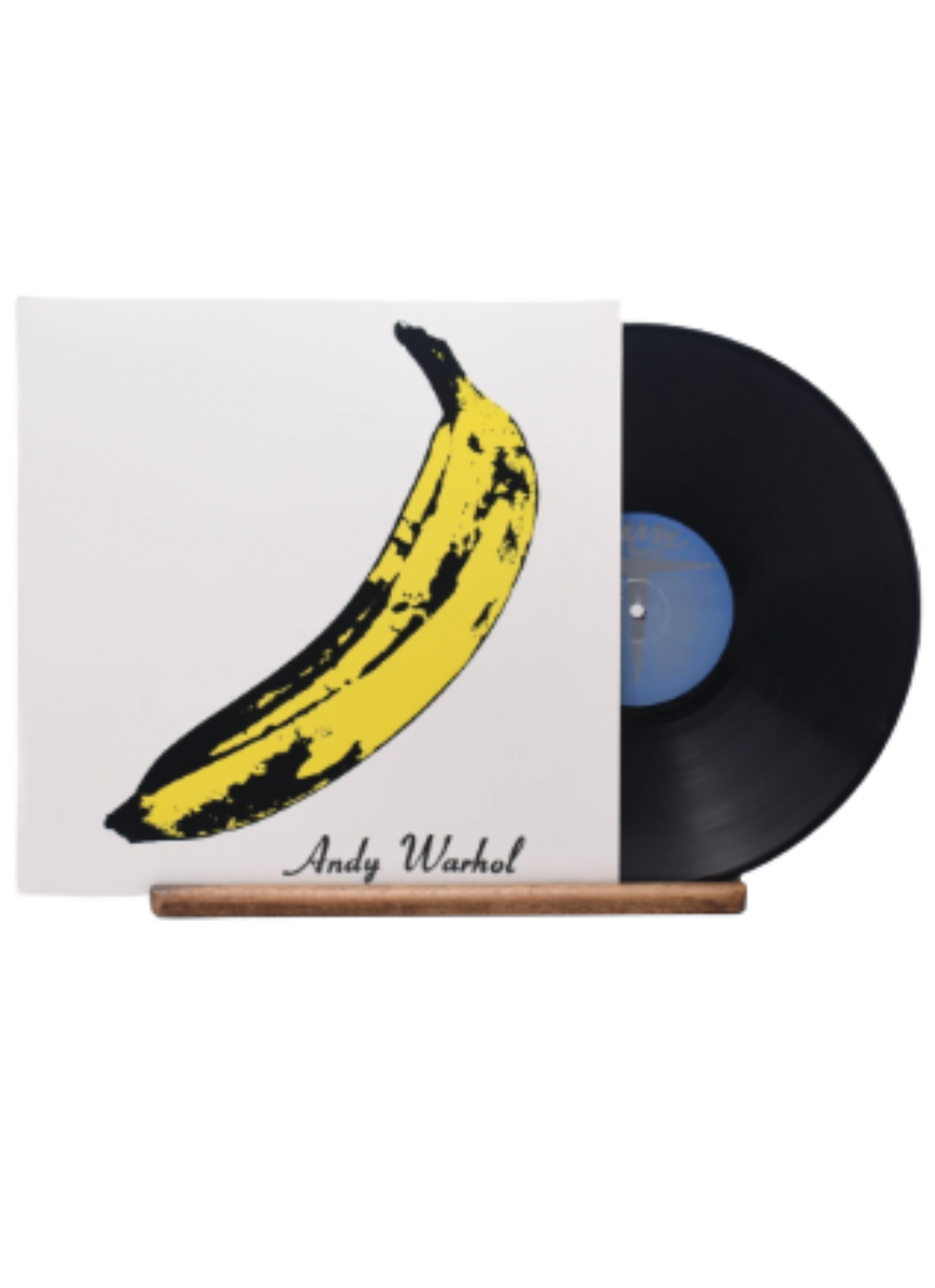

For collectors, audiophiles, and music enthusiasts alike, vinyl records represent more than mere music; they embody a tangible connection to music history, personal memories, and cultural heritage that spans generations. Each vinyl record is a unique artifact, often rich with stories and experiences tied to its listening history, making them invaluable treasures in any collection. Whether your collection comprises rare first pressings, signed albums celebrating iconic artists, or vintage classics that have stood the test of time, specialized vinyl record insurance ensures that your cherished records are protected against unforeseen loss or damage. This type of coverage is essential, particularly given the potential appreciation of these items, reinforcing the need for protection against accidents, theft, or environmental factors.

Your Vinyl Collection Is More Than Items & PCI Understands That Like Nobody Else

The world of vinyl collecting is continuously evolving, with new albums frequently released. Many specialized insurance policies include provisions for new acquisitions, guaranteeing that recently purchased records are automatically covered as soon as they enter your collection. This seamless integration ensures that there are no gaps in your coverage, providing you with peace of mind as your vinyl collection grows.

Insurance for Vinyl Records

Owning a vinyl collection is a rewarding and passionate pursuit, but it can also bring its share of stress. With vinyl record insurance in place, collectors can truly relax and indulge in their music. Whether displaying prized records in your home, lending them to friends or institutions, or actively seeking new additions, knowing that your collection is fully insured allows you to immerse yourself in your passion without the constant worry of potential loss or damage. With peace of mind, you can concentrate on appreciating the artistry and history embedded in every groove of your vinyl records.

Collectors Should Never Rely On Their Homeowners Policy

PCI’s blanket coverage is a key feature of specialized vinyl record collection insurance, designed specifically for collectors whose collections are always evolving. As you add new albums, rare editions, or valuable pressings, blanket coverage ensures your protection automatically grows with your collection—no constant updates or policy adjustments required.

New acquisitions are instantly covered under your existing policy, often without the need for prior notification, so every record you purchase is protected from the moment it becomes yours. This streamlined approach eliminates delays and paperwork, offering immediate peace of mind.

For passionate collectors, blanket coverage provides the confidence to keep growing their libraries without worrying about gaps in protection—combining flexibility, convenience, and security for both the sentimental and financial value of every record.

Risks Private Collection Insurance's Vinyl Records Insurance Could Cover

Blanket coverage also simplifies valuation by insuring your collection as a whole up to a set limit, rather than requiring each item to be individually appraised. This makes it easier to manage, while still ensuring your coverage reflects your collection’s overall worth.

Vinyl Record Collection Insurance FAQ

Vinyl record insurance is a specialized policy tailored to protect your collection against risks like theft, damage, and environmental hazards. Unlike homeowner’s insurance, it provides higher limits and covers the appraised value of your records.

A certified appraisal or detailed inventory is typically required to determine the value of your collection and ensure proper coverage. However, Private Collection Insurance also offers blanket coverage.

Most types of records can be insured, including first pressings, autographed albums, box sets, coloured variants, 7" singles, and limited-edition releases.

Yes, it typically covers accidental damage such as scratches, cracks, or damage during playback or handling.

Yes, specialized policies provide worldwide coverage, protecting your records at home, in transit, or stored in a facility.

As a collector, you most likely already maintain a detailed inventory of your collection through Discogs or Nasdisc. If not, maintain a spreadsheet with descriptions, label, condition, and photographs of each special or valuable record to simplify the claims process, should you need to.

You can update your policy to reflect the current market value of your collection with periodic appraisals or market evaluations.

Factors include the total value of your collection, the type of coverage chosen, the location where your records are stored the security measures in place (e.g., alarms), and if any of your albums are worth over $15,000.

Most specialized policies include coverage for environmental risks such as warping, mould, or moisture damage. Talk to PCI if you have questions.

Many policies include automatic coverage for new additions, ensuring your growing collection remains protected. This is especially true if you have blanket coverage up to a certain value, which would allow you to add to your collection without much worry.

Exclusions vary but may include damage due to intentional acts, general wear and tear, or improper storage conditions.

Insurance for High-Value Items & Collectibles

Private Collection Insurance (PCI) offers tailored insurance solutions designed to protect a wide range of rare and valuable items including, but not limited to Jewellery, Watches and Timepieces, Fine Art, Wine and Whiskey, Sports Cards, Comic Books, Memorabilia, Vinyl Records, Musical Instruments, Static Vehicle Collections, Coins, Firearms, Purses and Fashion, and other high-value items.

Want to Learn More? Book a 10-minute call.

Private Collection Insurance makes insurance protection simple and seamless. To begin the process, visit our application page to complete the relevant application form or briefly scroll down click to use our Contact Us form to get in touch with our team.